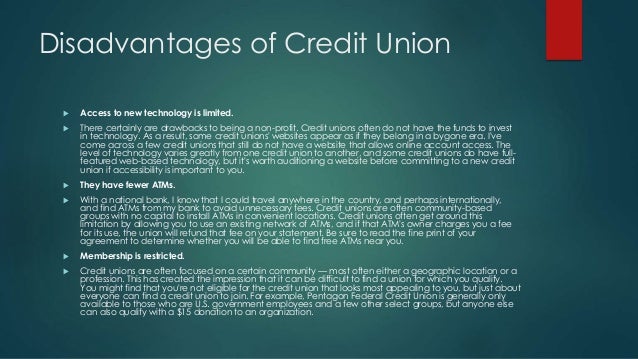

Limited accessibility. Credit unions tend to have fewer branches than traditional banks. A credit union may not be close to where you live or work, which could be a problem unless your credit union is part of a shared branch network and/or a large ATM network like Allpoint or MoneyPass. Not all credit unions are alike.

Moreover What credit score do I need for a MCU credit card? Compare to other cards

| BECU Visa Credit Card | Alaska Airlines Visa Signature® credit card |

|---|---|

| Intro APR 0% Intro APR on both purchases and balance transfers for 12 months. | Intro APR N/A |

| Recommended Credit Score 630850average – excellent | Recommended Credit Score 690850good – excellent |

Why you shouldn’t use a credit union? The downsides of credit unions are that your accounts could be cross-collateralized as described above. Also, as a general rule credit unions have fewer branches and ATMs than banks. However, some credit unions have offset this weakness by joining networks of surcharge-free ATMs. Some credit unions are not insured.

Herein Why would a credit union deny membership? If a bank or credit union denied your application for a checking account, it may be because a checking account reporting company has negative information in its files about your checking history.

What is the best credit union to bank with?

Best credit unions

- Best overall: Alliant Credit Union (ACU)

- Best for rewards credit cards: Pentagon Federal Credit Union (PenFed)

- Best for military members: Navy Federal Credit Union (NFCU)

- Best for APY: Consumers Credit Union (CCU)

- Best for low interest credit cards: First Tech Federal Credit Union (FTFCU)

How can I build credit? How to Build Credit

- Get a secured card.

- Get a credit-builder product or a secured loan.

- Use a co-signer.

- Become an authorized user.

- Get credit for the bills you pay.

- Practice good credit habits.

- Check your credit scores and reports.

How do I increase my credit limit with BECU? To request a credit line increase, you may submit an application through Online Banking, over the phone at 800.233. 2328, or in-person at any of our locations.

What credit agency does BECU use? The FICO® Score 8 based TransUnion data that is being made available to you through this program is the specific score that we use to manage your account.

Are credit unions safer than banks?

Why are credit unions safer than banks? Like banks, which are federally insured by the FDIC, credit unions are insured by the NCUA, making them just as safe as banks. … The NCUSIF provides all members of federally insured credit unions with $250,000 in coverage for their single ownership accounts.

What is a good credit score? Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Does a credit union help your credit?

Since credit unions traditionally charge fewer fees for their accounts and loans, their members keep more of their hard-earned money. … If you’re a credit union member trying to improve your credit rating, you can use those savings to pay down your debt, which may help you increase your credit score.

What is the minimum credit score for a credit union loan? The minimum credit score needed for a personal loan with no origination fee and no collateral requirement is 660, which is fair credit. And borrowers will need good credit or excellent credit – a credit score of 700 or higher – to get the best personal loan rates.

Do credit unions check your credit?

According to Experian, one of the three main credit bureaus, banks and credit unions don’t check your credit score when opening these two bank accounts. They may instead run a ChexSystems report. … It shows any unpaid negative balances (from overdrafting), frequent overdraft fees, bounced checks and suspected fraud.

What banks use ChexSystems?

Monthly bank fees for checking accounts often range up to $15! Review our updated list of No-Chexsystems banks and credit unions to open a bank account online today.

…

20 Banks that don’t use ChexSystems for January 2022.

| Banks That Don’t Use ChexSystems | Account Name |

|---|---|

| US Bank | Easy Checking |

| Varo Bank | Varo Checking |

| Wells Fargo Bank | Clear Access |

• Jan 25, 2022

Who is the number 1 bank in America? List of largest banks in the United States

| Rank | Bank name | Total assets (billions of US$) |

|---|---|---|

| 1 | JPMorgan Chase | $3,758 |

| 2 | Bank of America | $3,085 |

| 3 | Citigroup | $2,362 |

| 4 | Wells Fargo | $1,955 |

What banks do rich people use? These ten checking accounts are designed with the wealthy in mind and are intended for banking clients who desire convenient access to cash with premium benefits.

- Bank of America Private Bank. …

- Citigold Private Client. …

- Union Bank Private Advantage Checking Account. …

- HSBC Premier Checking. …

- Morgan Stanley CashPlus.

How many bank accounts should I have?

An expert recommends having four bank accounts for budgeting and building wealth. Open two checking accounts, one for bills and one for spending money. Have a savings account for your emergency fund, then a second account for other savings goals.

What kind of bills build credit? What Bills Affect Credit Score?

- Rent payments.

- Utility bills.

- Cable, internet or cellphone bills.

- Insurance payments.

- Car payments.

- Mortgage payments.

- Student loan payments.

- Credit card payments.

How can I raise my credit score 40 points fast?

Quickly Increase Your Credit Score by 40 Points

- Always make your monthly payments on time. …

- Have positive information being reported on your credit report. …

- It is imperative to drop credit card debt altogether. …

- The last thing you can do is check your credit report for inaccuracies.

How can I raise my credit score to 800? Here are seven steps you can implement to get an 800 credit score:

- Check Your Credit Score. …

- Make On-Time Monthly Payments. …

- Keep Your Credit Utilization Below 30% …

- Consolidate Your Current Debt. …

- Report Your Monthly Bills to a Credit Bureau. …

- Avoid Closing Old Credit Accounts. …

- Avoid Too Many Hard Credit Inquiries.

What is good score for credit?

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

How much can you withdraw from BECU ATM? ATM Transactions – The maximum combined amount that you and any joint account holder(s) may withdraw from your account(s) via ATM will be at least Five Hundred Dollars ($500) per day. ….. b.

How much can I withdraw from BECU savings?

Previously, an excess transaction fee applied when more than six transfers or withdrawals were made from a savings or money market account to a checking account within a month. As this rule is now final, we have removed the reference to Excess Transaction Fees and Transaction Limitations from the Account Disclosure.

Don’t forget to share this post with BF 🔥 !